How to Build Your Credit

1. Create your credit builder account

A credit builder account is part loan, part savings account. The loan amount is deposited into a locked savings account. Choose an amount and term that fits your budget².

2. Make on-time payments

With each monthly payment, you will get closer to paying off the loan. Once you've paid off the loan, you unlock the savings².

How it Works

3. Increase your credit score¹

Your payment history will be reported to the three main credit bureaus. By making on-time payments, you can establish a positive payment history. This will build your credit history. On-time payments are the largest factor in determining your credit score³.

4. Unlock your savings²

More than 85% of your payments toward the credit builder account come back to you as savings at the end of the term². In addition to building better credit history, you can have a rainy day fund at the end of the loan!

Benefits of the Build Credit Builder Loan

-

No Credit Check or Hard Pull

You can get started today, without a credit check. There is no hard pull on your credit.

-

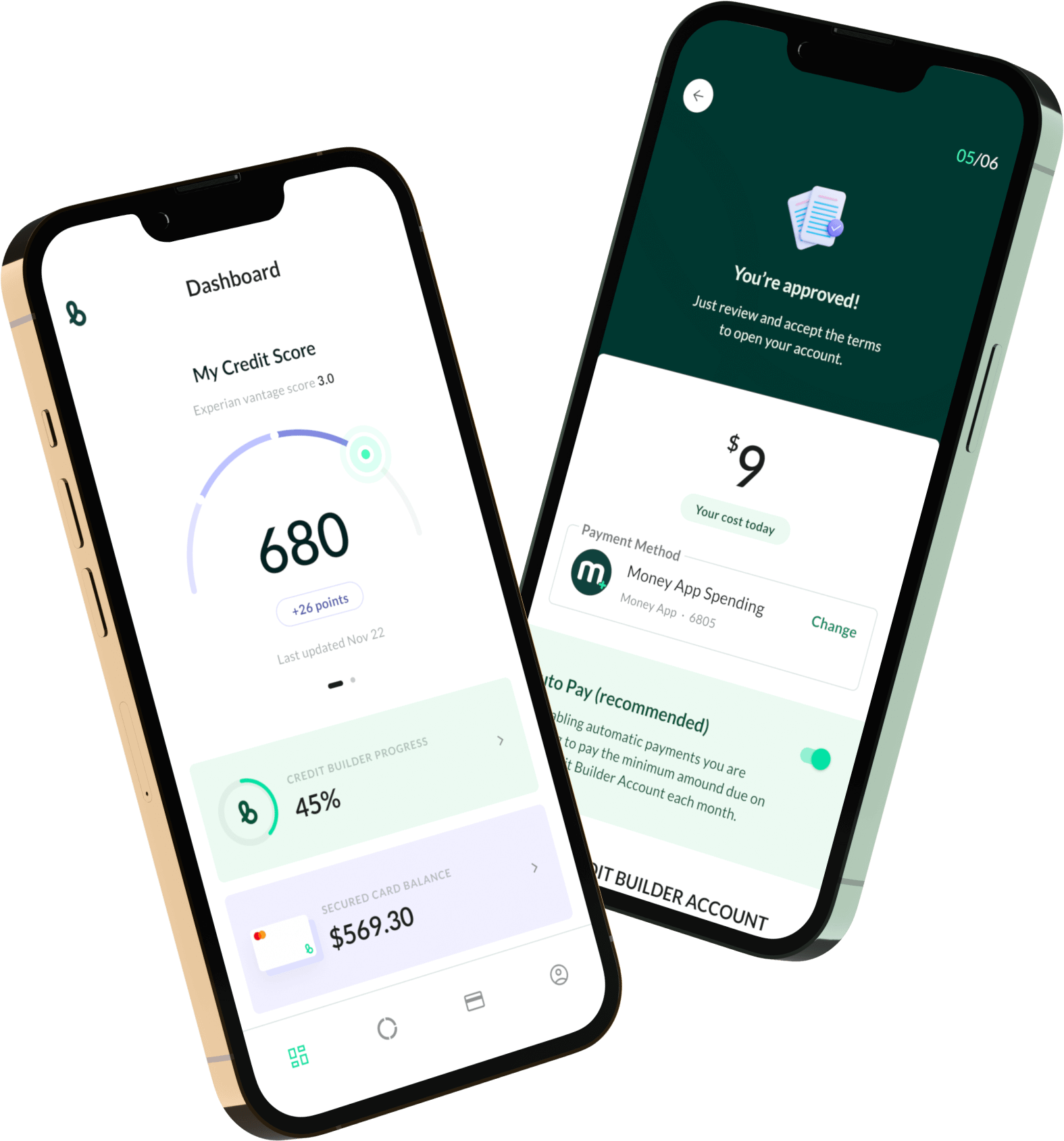

Know Your Credit Score

Your Build Dashboard lets you access and track your credit score, so you know where you stand.

-

Automated For Your Convenience

Each month, we can help simplify building your credit when you select automated payments. Stay on track to keep building your credit.

-

Cancel Anytime⁴

If, for any reason, you are unable to make your payment, you can close your account at any time.

Credit Building Plans

STARTER

for 24 months

You Build:$520

-

Admin fee

$9 -

Total Payment

$600 -

Get Back

$520 -

Final Costs

$89 -

APR

15.92%

INTERMEDIATE

for 24 months

You Build:$724

-

Admin fee

$9 -

Total Payment

$840 -

Get Back

$724 -

Final Costs

$125 -

APR

15.97%

VALUE BUILDER

for 12 months

You Build:$539

-

Admin fee

$9 -

Total Payment

$576 -

Get Back

$539 -

Final Costs

$46 -

APR

15.65%

EXPERT SAVER

for 12 months

You Build:$1663

-

Admin fee

$9 -

Total Payment

$1800 -

Get Back

$1663 -

Final Costs

$146 -

APR

15.91%

Why it works

Payment history is the LARGEST driver of credit scores generated by common scoring models such as FICO³. We can help.

-

Payment History 35%

-

Amount Owed 30%

-

Credit Mix 15%

-

Length of Credit History 10%

-

New Credit 10%

FAQ

About Us

Build is a financial technology company that believes everyone should have the opportunity to improve their financial health. We’ve worked hard to provide you with access to credit-building products like the Build Credit Builder Loan, which will allow you to add positive credit history to your credit report1 while also building personal savings2. In addition, we give you access to articles and content that further educate you about personal finances.

What is a Credit Builder Loan?

A Credit Builder Loan is a secured installment loan that is designed to help you demonstrate your creditworthiness. When you make regular, on-time payments toward your Credit Builder Loan, the lender reports your positive credit history to the credit bureaus, which is a key ingredient for boosting your credit score. One thing to know about Credit Builder Loans is that, unlike traditional loans, you can only access the money once the loan is paid in full or the Credit Builder Loan account is closed. In other words, at the end of the loan period, you will receive your money (less interest and fees) and the benefit of having all credit bureaus notified of your payment history.

How does a Credit Builder Loan work?

You pick a Build Credit Builder Loan that works for you, apply, and if approved, your Credit Builder Loan account is established. As you make monthly payments on your loan, that activity is reported to the credit bureaus each month, which may add to your positive credit history. Keeping up with payments on your Build Credit Builder Loan is important because it shows your ability to make timely payments on a credit account. The most commonly used credit scores, such as FICO and VantageScore consider this timely repayment history as the biggest determinant of your credit score.

When your loan is made, it is deposited into a secured savings account. You cannot access your Loan until you finish making all payments or your account is closed. When you finish making your payments or the loan account is closed, you receive your money (less interest and fees) . For example, for the Starter Loan your loan amount is $520. You make $25 monthly loan payments for 24 months and there is a $9 administration fee. 15.92% Annual Percentage Rate. By the end of your loan term, you will have paid $609 ($89 cost).

Who can apply for a Credit Builder Loan?

Applicants must satisfy the following criteria to be approved for a Loan:

- Must be 18 years old

- Must have a Debt-to-Income (DTI) ratio <=1, where:

- Debt equals the sum of 1) the stated total monthly debt obligations, including rent or mortgage obligations, and 2) the monthly payment required on the Credit Builder Loan

- Income equals the monthly income stated on the application

- If an applicant chooses a loan product that exceeds the DTI threshold, the applicant will be declined

- Must pass all customer identification and identity verification requirements

How fast can I raise my credit with a Credit Builder Loan?

This varies based on individual circumstances. The lender will report your account history to the credit bureaus each month; however, the time it takes to affect your credit score varies based on other factors, such as your prior and current history with credit, other outstanding debt, and payment history.

Are there any upfront fees?

Yes. The Credit Builder Loan has a one-time, non-refundable account opening fee of $9.

Will applying for a Build Credit Builder Loan cause a hard inquiry on my credit?

No. Your credit isn’t checked when you apply for a Build Credit Builder Loan.

Do you report to the credit bureaus?

To maximize the impact on your credit score, your payment history, regardless if its positive or negative, on your Build Credit Builder Loan will be reported to all three credit bureaus: Equifax, Experian, and Transunion.